Reports

2024 OLED Technology and Industry Trend Analysis Report for IT

₩5,000,000

September 11, 2024

PDF(158P)Introduction

This year, both Apple’s iPad Pro and Huawei’s MatePad Pro models were launched with tandem OLED technology applied to their tablet PCs. As Samsung Display and BOE finalize investments in 8.5-generation lines for IT products, the adoption of OLED in IT devices is gaining momentum. Furthermore, interest in OLED notebooks, known for their low power consumption, is increasing as on-device AI notebook ecosystems continue to develop.

Compared to OLED technology for smartphones, OLED technology for IT devices involves a wider variety of TFT (Thin Film Transistor) types, and the technologies for OLED and TFT substrates differ as well. The TFTs used for manufacturing IT OLEDs include LTPO-TFT and oxide TFT. While LTPO-TFT production for smartphone OLED is efficient on 6th-generation equipment, utilizing 8.6-generation glass substrates poses challenges due to the limitations of ELA (Excimer Laser Annealing) equipment. On the other hand, using oxide TFT requires the development of internal compensation technology and improved mobility to reduce bezel size. In terms of OLED cell technology, a two-stack tandem OLED structure is preferred over a single stack, as it offers better brightness and longevity. Hybrid OLED structures, which use a thin glass substrate and TFE (Thin Film Encapsulation), are also being adopted. As premium OLEDs become more widespread, the use of cover glass in IT devices is also expected to increase.

Panel manufacturers preparing for IT OLED production on 8.6-generation equipment are taking different strategic approaches, and the success of the IT OLED market will largely depend on which TFT and OLED structures are adopted. To address these trends, UBI Research has updated its 2023 IT OLED analysis report as follows:

– Detailed specifications of OLED tablets and notebook PCs, and their differences from LCD products

– OLED displays optimized for on-device AI notebooks

– The development status of oxide TFT and internal compensation circuits for IT OLED products by panel manufacturers

– Material composition, supply chain, and low grayscale challenges of tandem OLEDs

– Glass thinning and panel separation technologies for hybrid OLEDs

– Recent updates on photolithography OLED technology

– Glass reinforcement and coating technologies for cover windows

– UTG (Ultra-Thin Glass) and PF (Plastic Film) structures and supply chains for foldable IT products

– Updates on panel manufacturer capacities and market trends

This report serves as a key guideline for all companies involved in the OLED industry, outlining what needs to be prepared. Additionally, it forecasts the IT OLED market and highlights the growth potential of the industry.

Contents

2. OLED IT Product Trends

2.1 OLED tablet

2.2 OLED notebook PC

2.3 Development of foldable notebook PC

2.4 On-device AI OLED notebook PC

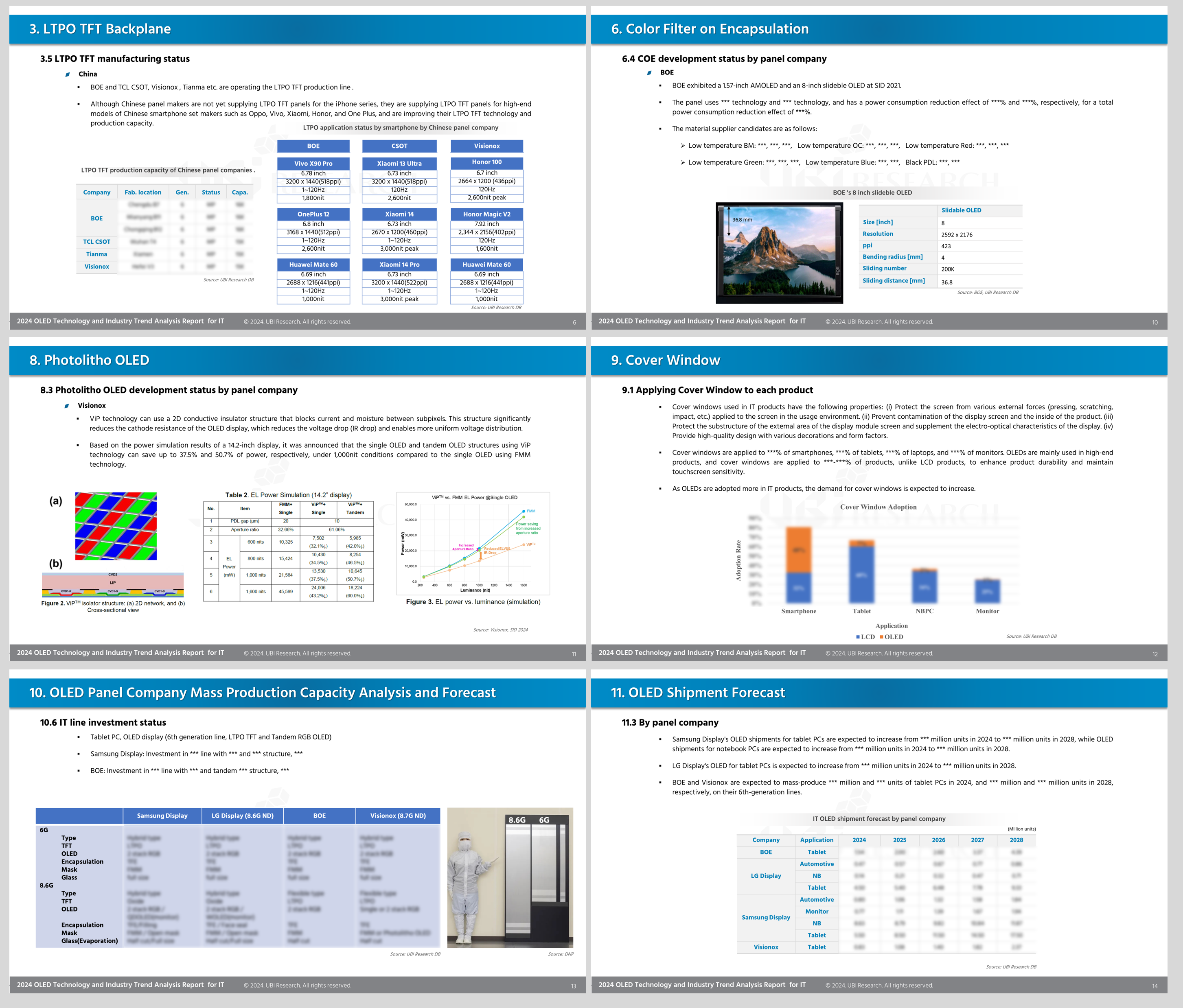

3. LTPO TFT Backplane

3.1 Comparison of LTPS, Oxide, LTPO TFT

3.2 Performance comparison of LTPS TFT

3.3 Principle of low power consumption of LTPO TFT panel

3.4 LTPO TFT applied products

3.5 LTPO TFT manufacturing status

3.6 LTPO TFT pixel circuit performance by company

3.7 LTPO TFT manufacturing cost issue

3.8 Low-cost LTPO TFT technology

4. 8th Generation Substrate TFT Backplane

4.1 LTPO TFT production

4.2 Oxide TFT development status

4.3 8G Response IGZO target suppliers

4.4 Need for high-mobility Oxide TFT

4.5 8th Generation IT-compatible Oxide TFT performance requirements

4.6 Internal compensation circuit of Oxide TFT for IT products

4.7 High mobility Oxide TFT

4.8 High resolution Oxide TFT

4.9 High reliability Oxide TFT

4.10 Short channel Oxide TFT

5. RGB Tandem OLED

5.1 Tandem OLED necessity

5.2 Comparison of Single OLED and Tandem OLED

5.3 Tandem OLED structure and supply chain

5.4 Tandem OLED device characteristics

5.5 Single OLED and Tandem OLED device structure

5.6 Tandem OLED issues (low-gradation color shift)

6. Color Filter on Encapsulation

6.1 The need for COE technology

6.2 Comparison of characteristics of polarizer applied panel and COE panel

6.3 COE process

6.4 COE development status by panel company

7. Hybrid OLED

7.1 Hybrid OLED advantages

7.2 Glass Thinning & Cell Separation

8. Photolitho OLED

8.1 Photolitho OLED technology

8.2 Photolitho OLED production process

8.3 Photolitho OLED development status by panel company

9. Cover window

9.1 Applying Cover Window to each product

9.2 Cover Window manufacturing process

9.3 Glass material

9.4 Glass manufacturing method

9.5 Cover Window performance and characteristics according to manufacturing method

9.6 Glass strengthening

9.7 Glass surface coating

9.8 Cover glass suppliers

9.9 Cover glass development

9.10 Foldable Cover Window structure

9.11 Ultra Thin Glass manufacturing

9.12 Foldable Cover Window supply chain

10. Analysis and forecast of mass production capacity of OLED panel companies

10.1 Samsung Display

10.2 LG Display

10.3 BOE

10.4 Visionox

10.5 OLED line capacity for IT by company

10.6 IT line investment status

11. OLED shipment forecast

11.1 Total

11.2 By application

11.3 By panel company

Report Sample

Previous report

Related Products

-

IT OLED Technology and Industry Trend Analysis Report

₩5,000,000October 19, 2023

PDF(79P)‘IT OLED Technology and Industry Trend Analysis Report’ provides a detailed analysis of various technologies that will determine IT OLED performance, yield, and manufacturing cost. By closely analyzing the technologies needed to manufacture high-performance TFTs and OLEDs and the challenges that need to be solved, it will serve as a guideline that tells companies in the OLED industry what to prepare.

-

Micro-LED Display Technologies for XR Applications

₩0January 22, 2025

PDF(109p)Micro-LED display is gaining attention as a next-generation display after OLED display. Surely before commercialization, there are several improvements required on manufacturing processes, production costs, full-color implementation, and yield management.

-

2025 Automotive Display Technology and Industry Trends Analysis Report

₩0February 18, 2025

PDF(217P)The automotive industry is undergoing rapid transformation beyond mere mechanical innovation, entering the era of Software-Defined Vehicles (SDVs). As autonomous driving technology and electric vehicle advancements accelerate, cars are evolving from simple transportation tools into smart devices centered around user interaction.