Special Report

Microdisplay Technical Report for XR Devices

₩5,000,000

October 31, 2023

PDF(154p)Introduction

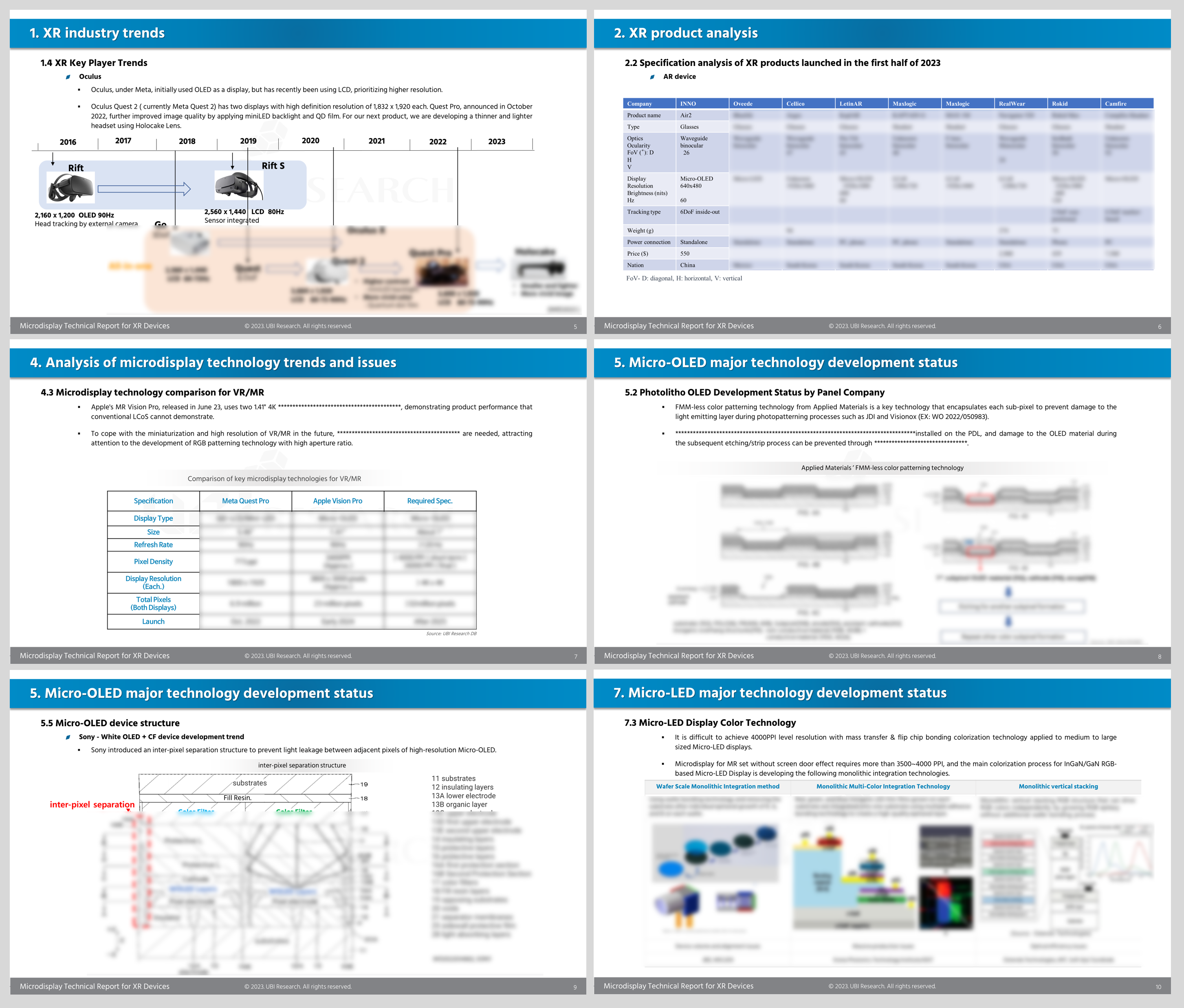

The XR (MR/VR/AR) market will accelerate further as AI Smart search makes application content richer and product experience more tangible. In preparation for the blooming of the future metaverse market, major IT companies such as Apple, Meta, Google, Samsung, TCL, and Xiaomi are focusing their capabilities on developing technologies and products that can provide value to customers. This year, Apple announced the Vision Pro MR device, a new augmented reality platform, integrating sensor technology and a new OS to open the era of spatial computing based on the Spatial Operation System. Meta is continuing its efforts to evolve the technology of VR devices such as Gear VR, Quest, Quest 2, and Quest Pro, and recently announced a new product, VR Holocake.

Through XR industry trend analysis, the type, number, and ratio of displays for XR devices were analyzed, the product development trends and issues of micro-display were analyzed, and the technology development status was identified. According to research, among microdisplay devices, LCDs account for 38% of the total with 97 types, OLEDs account for 23% with 57 types, Micro-OLEDs account for 23% with 36 types, and micro-LEDs account for only 2%., more compact Micro-OLED will become the mainstream product for the time being. In the mid to long term, LCoS and OLEDoS are expected to be the main technologies for VR/MR headsets, and OLEDoS and LEDoS for AR glasses.

The Micro-OLED industry is continuously making efforts to increase luminance and resolution. In the future, Microdisplay without the Screen Door Effect is required to develop a display with a resolution of 4,000 ppi and a luminance of 10,000 nit or more. To produce high-resolution RGB micro-OLED, the development of color patterning technology using photolithography, high-definition fine metal mask (FMM), and technology using silicon fine shadow mask instead of metal are being reported. The content was analyzed by reflecting relevant patents and expert opinions.

XR devices require high-brightness micro displays due to large losses in the optical system, and micro-LEDs capable of high brightness are receiving a lot of attention. Micro-LED is very sensitive to current, so it is difficult to secure uniformity even on a 12-inch wafer, and it is difficult to secure yield with current equipment to transfer the micro-LED to the driving substrate and connect it to the electrode. Survey statistics show that micro-LED has not yet reached the desired level in terms of technology and cost. However, micro-LED enables miniaturization, weight reduction, and high brightness of AR devices, and has great potential for future market demand for application products ranging from small to large, so development enthusiasm is increasing as the number of development products has increased in recent years. Companies in Taiwan and China have recently been making efforts to become leaders. Accordingly, the development of key technologies such as micro-LED-related high-efficiency Red Micro-LED chips, full color, and monolithic devices is in progress.

The “Microdisplay Technology Report for XR Devices” will be a useful guideline for companies and researchers working in the display industry to easily identify research trends and development directions by closely analyzing XR industry trends and technologies and challenges needed to manufacture microdisplays for high-performance XR devices.

Contents

1.1 Trends and Analysis Summary

1.2 XR Definition and Industry Components

1.3 Major released products by display

1.4 XR Key Player Trends

2. XR product analysis

2.1 XR products launched in the first half of 2023

2.2 Specification analysis of XR products launched in the first half of 2023

2.3 Analysis of display trends for XR products

2.4 Analysis of display trends for AR products

2.5 Analysis of display trends for MR products

2.6 Analysis of display trends for VR products

2.7 Display trends and resolution analysis

3. Analysis of XR device trends and issues

3.1 Top 9 XR device companies

3.2 Risks and success factors in the XR industry

3.3 Apple MR device issue analysis

4. Analysis of microdisplay technology trends and issues

4.1 Microdisplay technology types and characteristics

4.2 Microdisplay development target zone for XR

4.3 Microdisplay technology comparison

5. Micro-OLED major technology development status

5.1 Overview

5.2 Photolitho OLED Development Status by Panel Company

5.3 Ultra-high density FMM (Fine Metal Mask)

5.4 Ultra-high-definition shadow mask

5.5 Micro-OLED device structure

5.6 High-Resolution Color Filter

5.7 Black PDL (Pixel define layer) material

5.8 Encapsulation Technology

5.9 TFE of Micro-OLED

6. Status of Micro-OLED major products and companies

6.1 Sony

6.2 LG Display

6.3 Samsung Display

6.4 SeeYa Display (合肥视涯显示科技有限公司)

6.5 BOE

6.6 TCL CSOT

6.7 EPSON

6.8 eMagin

6.9 Kopin

6.10 Summary

7. Micro-LED major technology development status

7.1 Epi and Chip related issues

7.2 High-resolution technology for Micro-LED Display

7.3 Micro-LED Display Color Technology

7.4 Micro-LED mass-transfer technology

8. Status of Micro-LED major products and companies

8.1 Micro-LED Display Trend

8.2 Increasing trend of developed products using Micro-LED (LEDoS)

8.3 Micro-LED product development trends for microdisplay by major companies

9. Summary and outlook

Report Sample

Previous Report Status

Related Products

-

2024 XR Devices and Micro-display Megatrends Analysis Report

₩0September 9, 2024

PDF(179P)XR is emerging as a key industry that will drive the next generation of IT, following the innovations brought by smartphones, and holds immense value. In the 21st century, smartphones revolutionized the IT industry by integrating features like cameras, gaming, and digital wallets, becoming the leading IT device that continues to evolve.

-

2024 OLEDoS Industry and Technology Report

₩0October 30, 2024

PDF(155p)This report is centered around OLEDoS (Organic Light Emitting Diode on Silicon) technology, providing a comprehensive analysis of XR devices, market conditions, industry trends, and key manufacturing and technical issues. It covers the current state of product development, major technological challenges, supply chain analysis, and essential materials. The report highlights the latest trends in the XR market and underscores the critical role OLEDoS plays in XR devices, offering a detailed analysis of key technologies and material advancements.

OLEDoS combines the advantages of both LCoS and LEDoS while addressing their limitations, making it the most promising micro-display technology for XR devices due to its scalability for mass production. The report thoroughly outlines the significant technical issues associated with OLEDoS and includes research trends aimed at solving these challenges.

The success of the OLEDoS industry hinges on strong collaboration between the supply chain, manufacturers, consumers, and research institutions. This report is designed to offer valuable insights into the cooperative efforts necessary to drive success in the OLEDoS sector. -

Micro-LED Display Technologies for XR Applications

₩0January 22, 2025

PDF(109p)Micro-LED display is gaining attention as a next-generation display after OLED display. Surely before commercialization, there are several improvements required on manufacturing processes, production costs, full-color implementation, and yield management.