Special Report

Microdisplay Technical Report for XR Devices

₩5,000,000

October 31, 2023

PDF(154p)Introduction

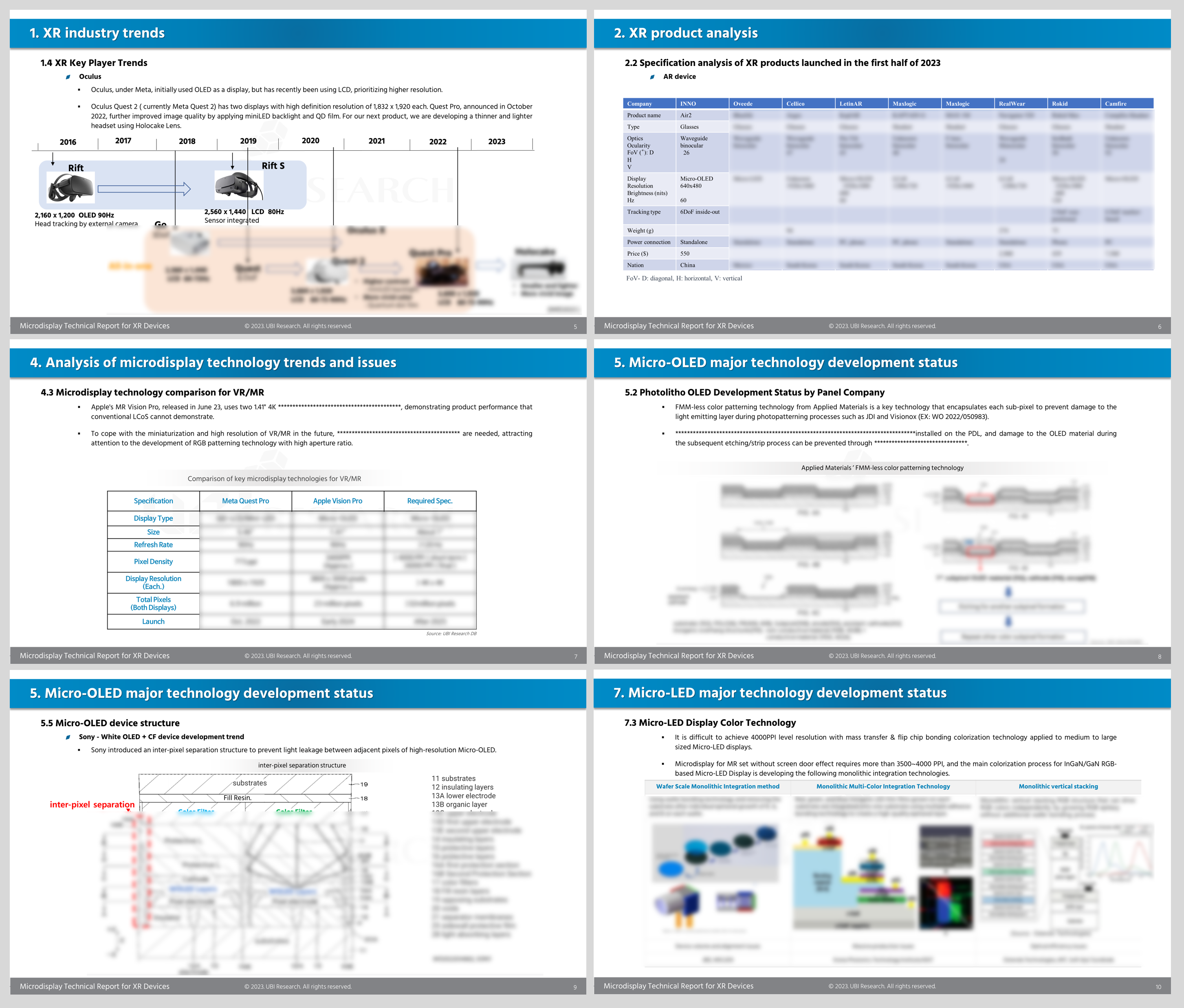

The XR (MR/VR/AR) market will accelerate further as AI Smart search makes application content richer and product experience more tangible. In preparation for the blooming of the future metaverse market, major IT companies such as Apple, Meta, Google, Samsung, TCL, and Xiaomi are focusing their capabilities on developing technologies and products that can provide value to customers. This year, Apple announced the Vision Pro MR device, a new augmented reality platform, integrating sensor technology and a new OS to open the era of spatial computing based on the Spatial Operation System. Meta is continuing its efforts to evolve the technology of VR devices such as Gear VR, Quest, Quest 2, and Quest Pro, and recently announced a new product, VR Holocake.

Through XR industry trend analysis, the type, number, and ratio of displays for XR devices were analyzed, the product development trends and issues of micro-display were analyzed, and the technology development status was identified. According to research, among microdisplay devices, LCDs account for 38% of the total with 97 types, OLEDs account for 23% with 57 types, Micro-OLEDs account for 23% with 36 types, and micro-LEDs account for only 2%., more compact Micro-OLED will become the mainstream product for the time being. In the mid to long term, LCoS and OLEDoS are expected to be the main technologies for VR/MR headsets, and OLEDoS and LEDoS for AR glasses.

The Micro-OLED industry is continuously making efforts to increase luminance and resolution. In the future, Microdisplay without the Screen Door Effect is required to develop a display with a resolution of 4,000 ppi and a luminance of 10,000 nit or more. To produce high-resolution RGB micro-OLED, the development of color patterning technology using photolithography, high-definition fine metal mask (FMM), and technology using silicon fine shadow mask instead of metal are being reported. The content was analyzed by reflecting relevant patents and expert opinions.

XR devices require high-brightness micro displays due to large losses in the optical system, and micro-LEDs capable of high brightness are receiving a lot of attention. Micro-LED is very sensitive to current, so it is difficult to secure uniformity even on a 12-inch wafer, and it is difficult to secure yield with current equipment to transfer the micro-LED to the driving substrate and connect it to the electrode. Survey statistics show that micro-LED has not yet reached the desired level in terms of technology and cost. However, micro-LED enables miniaturization, weight reduction, and high brightness of AR devices, and has great potential for future market demand for application products ranging from small to large, so development enthusiasm is increasing as the number of development products has increased in recent years. Companies in Taiwan and China have recently been making efforts to become leaders. Accordingly, the development of key technologies such as micro-LED-related high-efficiency Red Micro-LED chips, full color, and monolithic devices is in progress.

The “Microdisplay Technology Report for XR Devices” will be a useful guideline for companies and researchers working in the display industry to easily identify research trends and development directions by closely analyzing XR industry trends and technologies and challenges needed to manufacture microdisplays for high-performance XR devices.

Contents

1.1 Trends and Analysis Summary

1.2 XR Definition and Industry Components

1.3 Major released products by display

1.4 XR Key Player Trends

2. XR product analysis

2.1 XR products launched in the first half of 2023

2.2 Specification analysis of XR products launched in the first half of 2023

2.3 Analysis of display trends for XR products

2.4 Analysis of display trends for AR products

2.5 Analysis of display trends for MR products

2.6 Analysis of display trends for VR products

2.7 Display trends and resolution analysis

3. Analysis of XR device trends and issues

3.1 Top 9 XR device companies

3.2 Risks and success factors in the XR industry

3.3 Apple MR device issue analysis

4. Analysis of microdisplay technology trends and issues

4.1 Microdisplay technology types and characteristics

4.2 Microdisplay development target zone for XR

4.3 Microdisplay technology comparison

5. Micro-OLED major technology development status

5.1 Overview

5.2 Photolitho OLED Development Status by Panel Company

5.3 Ultra-high density FMM (Fine Metal Mask)

5.4 Ultra-high-definition shadow mask

5.5 Micro-OLED device structure

5.6 High-Resolution Color Filter

5.7 Black PDL (Pixel define layer) material

5.8 Encapsulation Technology

5.9 TFE of Micro-OLED

6. Status of Micro-OLED major products and companies

6.1 Sony

6.2 LG Display

6.3 Samsung Display

6.4 SeeYa Display (合肥视涯显示科技有限公司)

6.5 BOE

6.6 TCL CSOT

6.7 EPSON

6.8 eMagin

6.9 Kopin

6.10 Summary

7. Micro-LED major technology development status

7.1 Epi and Chip related issues

7.2 High-resolution technology for Micro-LED Display

7.3 Micro-LED Display Color Technology

7.4 Micro-LED mass-transfer technology

8. Status of Micro-LED major products and companies

8.1 Micro-LED Display Trend

8.2 Increasing trend of developed products using Micro-LED (LEDoS)

8.3 Micro-LED product development trends for microdisplay by major companies

9. Summary and outlook

Report Sample

Previous Report Status

Related Products

-

Micro Display Technology Report

₩5,000,000December 15, 2021

Glasses-type wearable devices are attracting attention as cutting-edge IT products that will succeed smartphones and smart watches. Wearable devices are being used in various industries, from AR and VR to XR and MR. Google, Facebook, and Sony are already releasing AR Glass with various performances, and are spurring software development along with hardware development. The most important part of the glasses-type wearable device is the micro display. In particular, AR, XR, and MR devices are required to display high definition, high brightness, and light weight because virtual reality or augmented reality must be displayed in accordance with reality. This report analyzed the latest development trends of micro display and included them by technology. It is structured so that companies that are promoting the next-generation wearable device business and software business can know the direction of the micro display industry.

-

2022 Micro-display Technology Report

₩5,000,000March 22, 2022

PDF(116p)As the mobile phone of the past had evolved into the smartphone we know today, the smart era that had begun is teeming to evolve once again. This time it is in the form of wearables as in Augmented Reality Glasses otherwise known as, AR Glasses.

A smartphone is classified as a mobile device because it can be carried around and carried in a bag or pocket. However, AR Glasses are classified as wearable devices because it is a device worn on the face.

AR Glasses have transparent glass on the front just like any ordinary glasses and the information to be displayed is also imaged on this glass. This gives the user the advantage to see information immediately while walking. In addition, various information can be displayed on top of visible objects through the transparent glass, making it a new experience different from previous information devices.

As micro-displays, which make up AR Glasses, there are LCoS (liquid crystal on silicon), OLEDoS (OLED on silicon), micro-LED, MEMS, etc., in which liquid crystal or OLED is placed on a silicon substrate.

In addition to AR Glasses, VR devices are establishing themselves as essential devices in the Metaverse Era. VR devices will provide a more immersive experience for games and movies than any other preceding devices. For VR displays, micro-displays are mainly used.

Accordingly, the world’s best IT companies such as Apple, Meta, Google, and Sony are spurring on the development and commercialization of AR Glasses and VR devices.

AR Glasses and micro-displays for VR devices will establish themselves as game-changers. These devices are set to replace smartphones and game consoles, and other information devices within the coming years.

In this micro-display report, the product trends of AR Glasses, VR device developers, and the current development status of micro-display (a key component of AR and VR) were thoroughly investigated to analyze technological progress and problems in detail. -

Technical Report for Micro-LED Display

₩0June 11, 2024

PDF(124p)Micro-LED displays, which are attracting attention as one of the next-generation display technologies, use micrometer-sized LEDs, which are self-light-emitting elements, and have advantages such as high resolution, high brightness, high efficiency, and long lifespan.It is mainly being applied on a pilot basis to small-sized AR/VR devices and large-sized TV fields, but is expanding to various areas such as automotive, transparent, and microdisplay.

Korea, China, Taiwan, and the United States are leading the way in Micro-LED development. Among them, China provides national support and many Chinese companies are aggressively developing, and Taiwan is aiming to create a new market in the field of commercial displays using Micro-LED.

[Micro-LED Technology and Development Trends Report] published by UBI Research not only provides a detailed analysis of Micro-LED technology, but also includes the technology status and company status by application field, as well as Micro-LED application products and Micro-LED chip market forecasts. It’s a report. It will provide strategic direction as an important reference for companies working in the Micro-LED field.