At UBI Research’s

‘2022 OLED Korea Conference’

held on April 6th-8th, UBI Research CEO Choong-Hoon Lee gave a

presentation on, ‘OLED Market Review’.

CEO Lee presented the status of the entire OLED industry, market,

and outlook with a focus on issues in 2022. CEO Lee first announced the OLED TV

business, a major issue in the recent OLED industry. CEO Lee said, “The biggest

issue that has been heating up the OLED industry since the end of last year is

OLED TV. There are topics such as Samsung Display's re-entry into the large

OLED business, sales of QD-OLED TVs between Samsung Electronics and Sony, and

visualization of collaboration between Samsung Electronics and LG

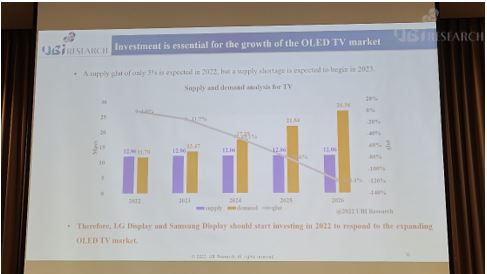

Display." In the TV OLED panel demand and supply

forecast, CEO Lee said, “If Samsung Electronics purchases OLED panels from LG

Display and conducts OLED TV business, LG Display and Samsung Display can

supply a total of 12 million TV OLED panels this year. Among them, demand is

11.7 million units, and oversupply accounts for only 3%.” In addition, “With

the joining of Samsung Electronics, the demand for OLED TV panels is expected

to expand to 13 million units in 2023 and 20 million units in 2025. According

to the expanding market, companies need to expand their facilities by the third

quarter of this year” he predicted.

CEO Lee continued, “LG

Display has been working hard to secure funds for 8.5 generation OLED

line expansion since last year, and it is estimated that it will secure

additional funds for 45K expansion within this year. With LG Display's

additional measures, the TV OLED panel market is expected to reach 13.5 million

units in 2023 and 16 million units after 2024. However, to secure a market of

more than 20 million units, it is necessary to plan to invest in the 10.5

generation by next year” he analyzed. He also said, “If Samsung Display

invests, 10.5G investment is desirable, but 8.5G investment is expected.” He

said, “Whether LG Display invests or Samsung Display invests, a long-term

supply contract with Samsung Electronics for 10.5G investment should take

precedence. If the investment proceeds, Samsung Display is expected to secure

its own funds, but LG Display is expected to require joint investment with

Samsung Electronics.”  ‘2022 OLED Korea Conference’ was a conference for exchange of ideas, business relationships, and

partnerships with renowned speakers from major companies in the display

industry from all over the world. ‘2022 OLED Korea Conference’ held a business

conference on the 7th and 8th, beginning with a tutorial on April 6th.

|