Special Report

2019 Automotive OLED Display Report

₩5,000,000

December 17, 2019

Introduce

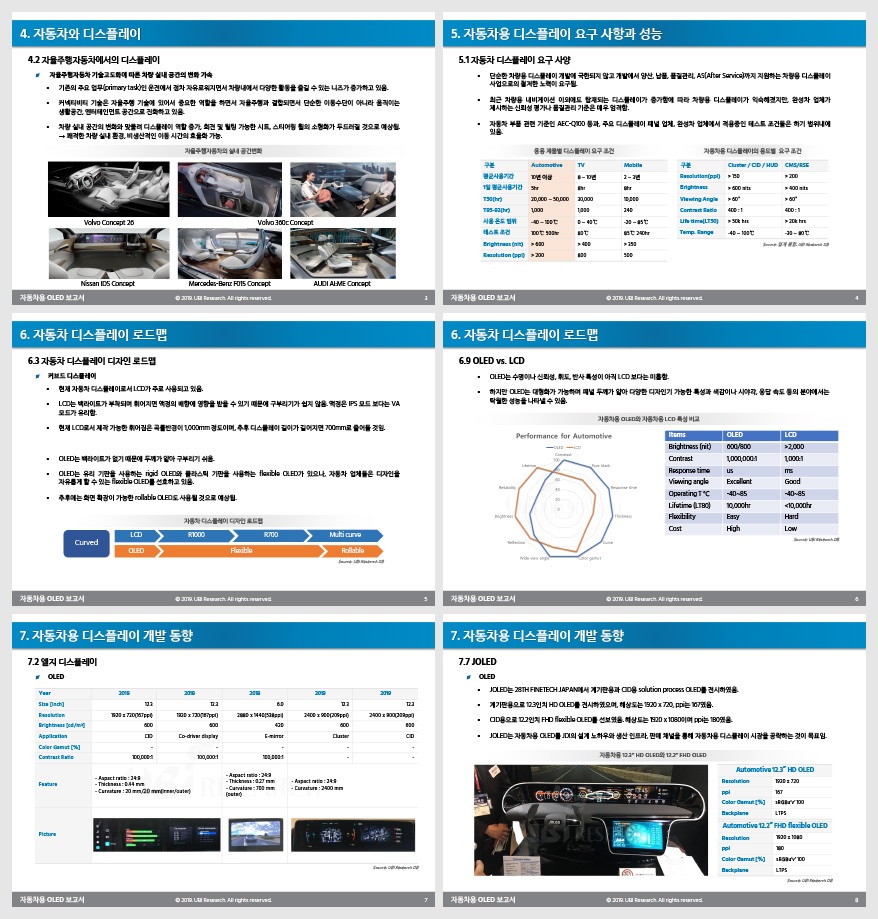

With the development of battery capacity and rapid charging technology, the era of electric vehicles is coming, and autonomous driving technology and 5G communication technology are combined to transform the automobile industry into a new aspect.

In the era when a mobile phone and a house can be connected by combining communication technology with the current car, which remains in the simple transport function, various information can be processed inside the car, so the display used in the dashboard of the car is also increased in size and high definition at the monitor level Is required.

Although the colorster and 5-7 inches in the instrument panel and 7-9 inches for CID are mainly used, it is expected that these two types of displays will be combined into one 20-inch display in the future.

Automotive experts predict that when a display larger than 20 inches is used in automobiles, flexible OLED will become an essential part.

Inside a car, a curved display similar to an aircraft cockpit is the first thing that is needed in order for the driver to see information on a large display. LCD made of glass is also possible, but if the display becomes larger, there is a problem that the display may be damaged in the event of vibration or collision while driving.

In this report, we analyzed the roadmap of automobile displays that will become the flagship product line of OLEDs following smartphones, showing how flexible OLEDs should be developed.

The automotive OLED market is still in its infancy, but the day when the 20-inch flexible OLED will be used in the passenger car market of more than 100 million units per year is expected to be not far away.

Contents

1. Smart Car

1.1 Automobile Paradigm Shift

1.2 Connected Car

1.3 Self-Driving Car

1.4 Smart Car and Display

2. Automotive Display

2.1 Display Types and Usages

2.2 Development Prospects for Automotive Display

2.3 Reason why OLED is needed

3. OLED Display of Automobile Manufacturers & Automotive Electronics Companies

3.1 GEA

3.2 Audi

3.3 Denso

3.4 Harman

3.5 Futaba

3.6 Visteon

4. Automotive Display Development Trends of Panel Makers

4.1Requirements for Automotive Display

4.2 LG Display

4.3 Samsung Display

4.4 Visionox

4.5 BOE

4.6 AUO

4.7 Everdisplay와 Royole

4.8 Problems and Future Development Issues of Automotive OLEDs

5. Market Forecast for Automotive OLED Display

5.1 Summary

5.2 Overall Market Forecast

5.3 Market Forecast by Application

5.4 Market Forecast by Size

5.5 Market Forecast by Substrate

Report Sample

Previous report status

Related Products

-

2020 OLED Equipment Report

₩5,000,000April 1, 2021

PDF(134P)In the “2020 OLED Equipment Report” published this time, we analyzed the investment trends, utilization rates, and financial conditions of each panel maker in Korea and China. In addition, the development status of QD-Display being developed by Samsung Display and the manufacturing process of oxide TFT and color filter are included. Moreover, since the OLED equipment market has been categorized by process, generation, country, and equipment until 2023, it will be helpful for OLED-related equipment makers to formulate strategies to respond to the future market.

-

1Q 2021, OLED Manufacturing Equipment Market Track

₩5,000,000April 7, 2021

EXCELThe Equipment Market Track Report surveyed the equipment market by quarter by selecting equipment for each process required for OLED manufacturing.

The equipment market was analyzed by quarter and year by dividing by Major Process (Substrate, TFT, OLED, Encapsulation, Cell, Module), Company, Nation, Generation, and Substrate Type (Flexible, Rigid). The equipment market was estimated at the time of ordering for evaporation equipment. The Market Track Quarterly Report provides necessary information to industry leaders leading the OLED industry. -

AMOLED Manufacturing Process Report Ver.4

₩4,000,000January 5, 2022

PDF(291P)The AMOLED manufacturing process report analyzes the structure and manufacturing process by dividing AMOLED into small, medium-sized, and large-area. They also schematically design the inspection process of small and medium-sized AMOLED, so each company can understand the overall structure and core processes of AMOLED.

In the currently published AMOLED process report ver.4, the QD-OLED structure and process were updated, and the structure and process were added based on the decapsulated LTPO TFT applied to the Galaxy Note21.

This report is a must-read report for not only panel makers but also equipment, components, and materials makers to understand the AMOLED manufacturing process.