상점

Showing 82–90 of 123 results

-

AMOLED Manufacturing Process Report Ver.4

₩4,000,000January 5, 2022

The AMOLED manufacturing process report analyzes the structure and manufacturing process by dividing AMOLED into small, medium-sized, and large-area. They also schematically design the inspection process of small and medium-sized AMOLED, so each company can understand the overall structure and core processes of AMOLED.

In the currently published AMOLED process report ver.4, the QD-OLED structure and process were updated, and the structure and process were added based on the decapsulated LTPO TFT applied to the Galaxy Note21.

This report is a must-read report for not only panel makers but also equipment, components, and materials makers to understand the AMOLED manufacturing process. -

4Q 2021, OLED Manufacturing Equipment Market Track

₩5,000,000December 24, 2021

The Equipment Market Track Report surveyed the equipment market by quarter by selecting equipment for each process required for OLED manufacturing.

The equipment market was analyzed by quarter and year by dividing by Major Process (Substrate, TFT, OLED, Encapsulation, Cell, Module), Company, Nation, Generation, and Substrate Type (Flexible, Rigid). The equipment market was estimated at the time of ordering for evaporation equipment. The Market Track Quarterly Report provides necessary information to industry leaders leading the OLED industry. -

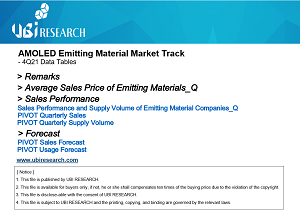

4Q 2021, OLED Emitting Material Market Track

₩6,000,000December 24, 2021

This quarterly emitting material market track report researched/analyzed the market of OLED emitting materials.

We analyzed the performance of each layer of emitting material and each company, and analyzed the total market of emitting materials and each layer by examining the sales of each emitting layer and common layer, and forecast the market by dividing by OLED method (RGB, WRGB, QD-OLED).

Also, for the next five years, the use of emitting materials and sales of each company were predicted to predict OLED market information until 2025. The Market Track Quarterly Report provides necessary information to industry leaders leading the OLED industry. -

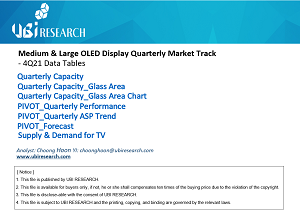

4Q 2021, Medium & Large OLED Display Market Track

₩5,000,000December 24, 2021

This report provides the OLED production capacity status, which is very important to all companies across the industry for small OLED displays of 10 inches or less, as well as shipments and sales performance by major panel makers and applications. In addition, detailed quarterly shipments, sales performance, ASP and OLED demand/supply analysis by application, and market forecast analysis data for the next five years are also provided for major product lines such as Watch, Smartphone, Foldable Phone and Tablet.

-

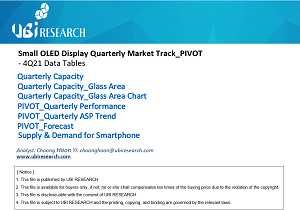

4Q 2021, Small OLED Display Market Track

₩10,000,000December 24, 2021

This report provides the OLED production capacity status, which is very important to all companies across the industry for small OLED displays of 10 inches or less, as well as shipments and sales performance by major panel makers and applications. In addition, detailed quarterly shipments, sales performance, ASP and OLED demand/supply analysis by application, and market forecast analysis data for the next five years are also provided for major product lines such as Watch, Smartphone, Foldable Phone and Tablet.

-

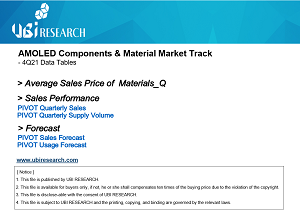

4Q 2021, OLED Components & Material Market Track

₩5,000,000December 24, 2021

This quarterly parts and materials market track report selected 20 major OLED parts and materials companies to conduct market research.

Substrate, TFT, Encapsulation, Touch sensor, Polarizer, Adhesive, Cover window, Module 8 categories were classified into the quarterly market, and market shares were analyzed by company and application (TV, Mobile).

In addition, it predicted the supply volume and market by parts and materials until 2025. The Market Track Quarterly Report provides necessary information to industry leaders leading the OLED industry. -

Micro Display Technology Report

₩5,000,000December 15, 2021

Glasses-type wearable devices are attracting attention as cutting-edge IT products that will succeed smartphones and smart watches. Wearable devices are being used in various industries, from AR and VR to XR and MR. Google, Facebook, and Sony are already releasing AR Glass with various performances, and are spurring software development along with hardware development. The most important part of the glasses-type wearable device is the micro display. In particular, AR, XR, and MR devices are required to display high definition, high brightness, and light weight because virtual reality or augmented reality must be displayed in accordance with reality. This report analyzed the latest development trends of micro display and included them by technology. It is structured so that companies that are promoting the next-generation wearable device business and software business can know the direction of the micro display industry.

-

2021 Flexible & Foldable OLED Report

₩6,000,000October 22, 2021

This report predicted that major panel companies would develop foldable and rollable devices, development trends of related materials, investment trends in flexible OLED lines by panel companies, market prospects for flexible OLEDs, and cover window markets for foldable phones.

Foldable and rollable device development trends by panel companies include panel companies’ development roadmaps, development trends, and exhibitions, which are expected to help companies who failed to attend related events as they include Chinese exhibitions such as DIC 2021 and UDE 2021.

Foldable-related material development trends dealt with the development trends of UTG and microlens arrays, pol-less, and under panel cameras. The trend of flexible OLED line investment by panel companies includes Samsung Display’s future investment and future investment direction due to excessive investment in 6th generation flexible OLEDs by Chinese panel companies, so it will help flexible OLEDs and foldable OLED-related companies understand the current and future. -

2021 Inkjet Technology Trend for Display Report

₩5,000,000October 22, 2021

This report focuses on inkjet devices and technologies used in OLED and QLED. Inkjet equipment was created by separating the companies that manufacture inkjet heads and systems.

As inkjet head makers, Fujifilm Dimatix, Epson, Konica Minolta, Ricoh, Xaar, and Panasonic were mentioned, and OLED encapsulation equipment makers Kateeva and UniJet were described.

Litrex, TEL (Tokyo Electron), Kateeva, Panasonic Production Engineering, and Toray Engineering are mentioned as inkjet device manufacturers used for Sol OLED.