Reports

2021 OLED Emitting Material Report

₩6,000,000

May 6, 2021

PDF(185P)Introduce

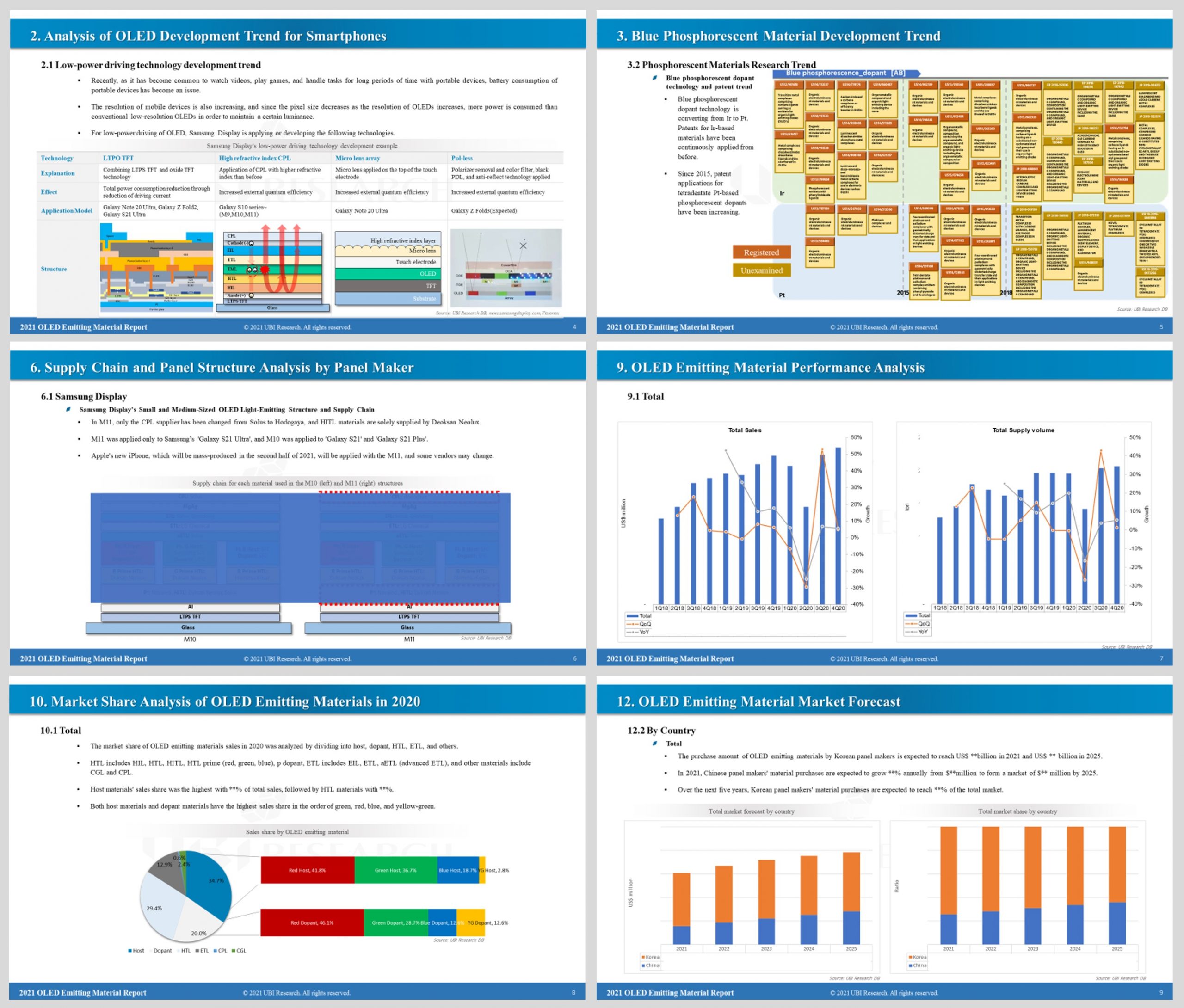

The “2021 OLED Emitting Material Report” published this time focused on the development trend of blue phosphorescent materials, such as

analysis of the possibility of commercialization of blue phosphorescence and analysis of competitiveness between blue phosphorescence and

next-generation blue emitting materials. In addition, the development trends of low-power driving technologies such as LTPO TFT, micro lens

array, and pol-less to reduce battery consumption of mobile devices are included. Moreover, since we have dealt with the analysis of panel

structure and supply chain by panel company, material performance analysis and material market forecast, it will be helpful for OLED emitting

material-related companies to plan strategies to respond to the future market.

Contents

2. Analysis of OLED Development Trend for Smartphones

2.1 Low Power Driving Technology Development Trend

2.2 LTPO TFT

2.3 High Refractive Index CPL

2.4 Micro Lens Array

2.5 Pol-less

3. Blue Phosphorescent Material Developemtn Trend

3.1 Phosphorescent Technology Introduction and Details

3.2 Phosphorescent Material Research Trend

3.3 Analysis of Commercial Possibility of Blue Phosphorescence

3.4 Anaysis of Competitiveness with next-generation Blue Emitting Material

4. Analysis of Correlation Between High Resolution OLED and Material Properties

4.1 Relationship Between OLED Resolution and Luminance

4.2 Relationship Between OLED Resolution and Lifetime

4.3 Relationship Between OLED Resolution and Power Consumption

4.4 Material Property Requirements according to OLED High Resolution

5. Business Trend By Emitting Material Company

5.1 Performance Analysis by Material Company

5.2 Patent Trend

6. Analysis of Panel Structure and Supply Chain by Panel Company

6.1 Smasung Display

6.2 LG Display

6.3 BOE

6.4 Visionox

6.5 Others

7.OLED Panel Maker Mass Production Capa Analysis and Forecast

7.1 Annual Total Substrate Area Forecast

7.2 Small OLED Annual substrate Area Fore cast

7.3 Medium-sized and Large OLED Annual Substrate Area Forecast

8. OLED Shipment Forecast

8.1 Total OLED Shipment

8.2 By Application

9. OLED Emitting Material Performance Analysis

9.1 Total

9.2 By Nation

9.3 By Panel Company

9.4 By Layer

9.5 By OLED Method

9.6 By Purpose

9.7 By Application

10. OLED Emitting Material Market Share Analysis

10.1 Analysis of OLED Emitting Material Sales Share in 2020

10.2 Host

10.3 Dopant

10.4 HTL

10.5 ETL

10.6 Other Materials

11. OLED Emitting Material Demand Forecast

11.1 Overview

11.2 Total

11.3 By Nation

11.4 By Panel Company

11.5 By Layer

11.6 By OLED Method

11.7 By Materials

12. OLED Emitting Material Market Forecast

12.2 Total

12.3 By Nation

12.4 By Panel Company

12.5 By Layer

12.6 By OLED Method

12.7 By Materials

Report Sample

Previous Report Status

Related Products

-

2023 OLED Emitting Material Report

₩6,000,000May 8, 2023

PDF(176P)In the “2023 OLED Emitting Material Report”, deals with the overall development trend of blue emitting materials, including blue phosphorescent materials that have recently attracted attention.

In the analysis of OLED industry issues, Samsung Display’s blue phosphorescent material development status, global 8.6G IT investment status, Samsung Display’s QD-OLED line future outlook, Samsung Display’s light emitting structure application status, TCL CSOT’s solution process OLED line investment possibility are included.

In the emitting material supply chain of each panel company, new emitting structures for Samsung Display’s QD-OLED and LG Display’s Guangzhou WOLED are updated, and the supply chain of Chinese panel makers is strengthened.

In the emitting material market performance, performance is analyzed by material company, and the emitting material market and demand are forecasted by country, panel company, and emitting material from 2023 to 2027. -

2024 OLED Emitting Material Report

₩6,000,000May 8, 2024

PDF(190P)The “2024 OLED Emitting Material Report” analyzed the latest trends in iPad Pro OLED, which recently began production, 8.6G IT line investment trends, tandem OLED emitting material development trends, and high-efficiency and long-life emitting materials.

In the emitting material supply chain for each panel company, we analyzed Samsung Display and LG Display’s 2-stack tandem OLED materials, iPhone 16 emitting materials, and the supply chains of Chinese panel companies.

In the emitting material market performance, the performance of each material company was analyzed, and the emitting material market and demand were forecast by country, panel company, and emitting material from 2024 to 2028.

The demand for OLED emitting materials is expected to be 131 tons in 2024, and the demand for emitting materials is expected to be 177 tons by 2028 with an average annual growth rate of 8.7%.

The size of the OLED emitting materials market is expected to grow from $2.4 billion in 2024 to $2.7 billion in 2028.

Korean panel companies’ OLED emitting material purchases are expected to increase from $1.4 billion in 2024 to $1.5 billion in 2028, and Chinese panel companies’ material purchases are expected to increase from $980 million in 2024 to $1.21 billion in 2028. do. -

2025 OLED Emitting Materials Report

₩0May 7, 2025

PDF(203P)“2025 OLED Emitting Materials Report” analyzes the latest trends and key issues in the OLED industry, offering a comprehensive review of the technology development directions of OLED panel makers and emitting material manufacturers. The report also includes an in-depth analysis of OLED panel production capacities, supply chains, and panel structures, as well as a detailed breakdown of emitting material performance and market size forecasts.

OLED displays are rapidly expanding across various sectors such as automotive, IT devices, and mid-to-low-end smartphones, driving significant growth in the emitting materials market. In particular, with the commercialization of tandem OLEDs that use multiple emitting layers, there is a surge in demand for high-performance materials such as CGL, p-dopants, and HTL. Leading panel manufacturers such as Samsung Display, LG Display, and BOE are steadily increasing their consumption of emitting materials. The global emitting materials market is projected to reach USD 2.89 billion in 2025 and USD 3.23 billion by 2029.

From a technological trend perspective, there is intense competition in high-efficiency and long-lifetime emitting technologies such as hyperfluorescence, TADF, and phosphorescent materials. Improving the external quantum efficiency and lifetime of blue materials, in particular, is emerging as a key challenge for market expansion. Amid active innovation in materials—such as deuterium substitution and boron-based fluorescent materials—Chinese companies are rapidly increasing their presence in dopant and host segments, becoming deeply embedded in the global supply chain.

This report serves as a valuable guideline for professionals in the display and materials industries by providing a comprehensive analysis of the OLED emitting materials industry, including market forecasts, major company strategies, and future technology development directions.