Reports

2024 OLED Emitting Material Report

₩6,000,000

May 8, 2024

PDF(190P)Introduction

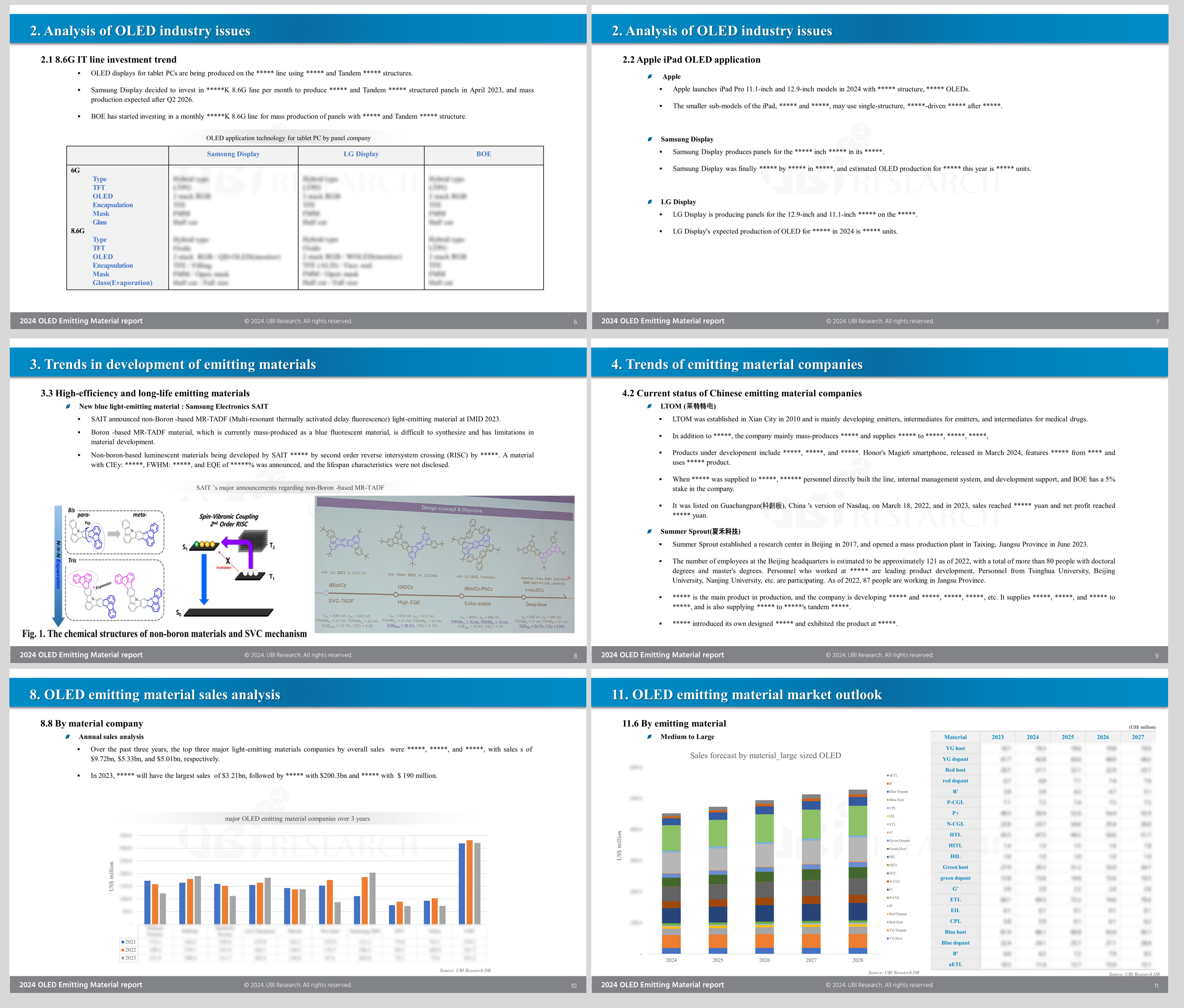

The “2024 OLED Emitting Material Report” analyzed the latest trends in iPad Pro OLED, which recently began production, 8.6G IT line investment trends, tandem OLED emitting material development trends, and high-efficiency and long-life emitting materials.

In the emitting material supply chain for each panel company, we analyzed Samsung Display and LG Display’s 2-stack tandem OLED materials, iPhone 16 emitting materials, and the supply chains of Chinese panel companies.

In the emitting material market performance, the performance of each material company was analyzed, and the emitting material market and demand were forecast by country, panel company, and emitting material from 2024 to 2028.

The demand for OLED emitting materials is expected to be 131 tons in 2024, and the demand for emitting materials is expected to be 177 tons by 2028 with an average annual growth rate of 8.7%.

The size of the OLED emitting materials market is expected to grow from $2.4 billion in 2024 to $2.7 billion in 2028.

Korean panel companies’ OLED emitting material purchases are expected to increase from $1.4 billion in 2024 to $1.5 billion in 2028, and Chinese panel companies’ material purchases are expected to increase from $980 million in 2024 to $1.21 billion in 2028.

Contents

2. Analysis of OLED industry issues

2.1 8.6G IT line investment trend

2.2 Apple iPad OLED application

2.3 iPhone Panel Suppliers

2.4 Increase in OLED shipments for mid- to low-priced smartphones

2.5 Expansion of Tandem OLED application

3. Trends in the development of emitting materials

3.1 Summary

3.2 Development trends of emitting materials for RGB Tandem OLED

3.3 High-efficiency and long-life emitting materials

3.4 Deuterium substitution

3.5 Soluble OLED

4. Trends of emitting material companies

4.1 Development and business trends by major companies

4.2 Current status of Chinese emitting material companies

5. Analysis and forecast of mass production capacity of OLED panel companies

5.1 Samsung Display

5.2 LG Display

5.3 BOE

5.4 TCL CSOT

5.5 EverDisplay Optronics

5.6 Tianma

5.7 Visionox

5.8 Line status by panel company

5.9 Annual substrate area forecast

5.10 Annual substrate area forecast for small OLED

5.11 Annual substrate area forecast for medium to large OLED

6. OLED shipment forecast

6.1 OLED total shipments

6.2 Shipments by application

7. Supply chain and panel structure analysis by panel company

7.1 Samsung Display

7.2 LG Display

7.3 BOE

7.4 TCL CSOT

7.5 Tianma

7.6 Visionox

8. OLED emitting material sales analysis

8.1 Summary

8.2 By country

8.3 By panel company

8.4 By Layer

8.5 By OLED structure

8.6 By Function

8.7 By Application

8.8 By material company

9. OLED emitting material market share analysis in 2023

9.1 Summary

9.2 Host

9.3 Dopant

9.4 HTL

9.5 ETL

9.6 Other materials

10. OLED emitting material demand forecast

10.1 Overview

10.2 All

10.3 By country

10.4 By panel company

10.5 By Layer

10.6 By OLED structure

10.7 By emitting material

11. OLED emitting material market outlook

11.1 Summary

11.2 By country

11.3 By panel company

11.4 By Layer

11.5 By OLED structure

11.6 By emitting material

Report Sample

Previous Report Status

Related Products

-

2021 OLED Emitting Material Report

₩6,000,000May 6, 2021

PDF(185P)The “2021 OLED Emitting Material Report” published this time focused on the development trend of blue phosphorescent materials, such as

analysis of the possibility of commercialization of blue phosphorescence and analysis of competitiveness between blue phosphorescence and

next-generation blue emitting materials. In addition, the development trends of low-power driving technologies such as LTPO TFT, micro lens

array, and pol-less to reduce battery consumption of mobile devices are included. Moreover, since we have dealt with the analysis of panel

structure and supply chain by panel company, material performance analysis and material market forecast, it will be helpful for OLED emitting

material-related companies to plan strategies to respond to the future market. -

2022 OLED Emitting Material Report

₩6,000,000May 18, 2022

PDF(137P)In “2022 OLED Emitting Material Report”, the current status of panel makers by line and future plans were carefully detailed. The annual substrate area was divided into small size and medium large size types and diagrammed.

The OLED industry issue analyzed Korean and Chinese panel makers’ IT line investment status and future forecasts, Samsung Display’s QD-OLED current status and future investment scenarios, and the possibility of diversification of iPhone panel suppliers.

The IT line investment included the future RGB 2stack OLED light-emitting material market and thickness for each layer.

The analysis for light-emitting material company business trends examined the reasons for the increase or decrease in the performance of each material company over the past three years. The status of major Chinese light-emitting material companies was also summarized.

The market and demand forecast from 2022 to 2026 for emitting materials will help OLED emitting material companies establish strategies for the future. -

2023 OLED Emitting Material Report

₩6,000,000May 8, 2023

PDF(176P)In the “2023 OLED Emitting Material Report”, deals with the overall development trend of blue emitting materials, including blue phosphorescent materials that have recently attracted attention.

In the analysis of OLED industry issues, Samsung Display’s blue phosphorescent material development status, global 8.6G IT investment status, Samsung Display’s QD-OLED line future outlook, Samsung Display’s light emitting structure application status, TCL CSOT’s solution process OLED line investment possibility are included.

In the emitting material supply chain of each panel company, new emitting structures for Samsung Display’s QD-OLED and LG Display’s Guangzhou WOLED are updated, and the supply chain of Chinese panel makers is strengthened.

In the emitting material market performance, performance is analyzed by material company, and the emitting material market and demand are forecasted by country, panel company, and emitting material from 2023 to 2027.